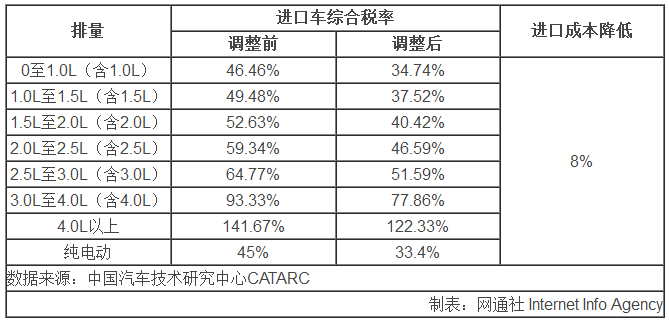

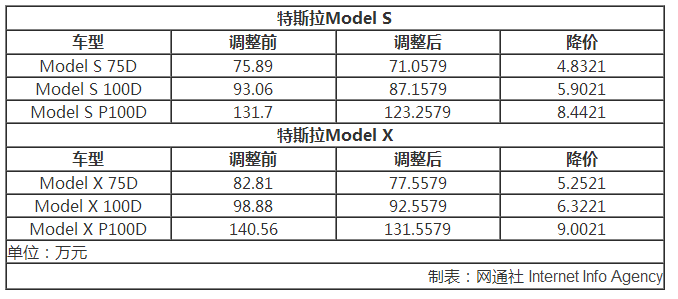

On May 22, the Customs Tariff Commission of the State Council issued an announcement that, starting on July 1, 2018, the tariff of auto vehicles will be reduced from the original 25% to 15%. This is the tenth time since China’s reform and opening up, China’s tariffs on imported cars have been lowered. After the release of the announcement, a number of domestic media calculated the proportion of imported vehicles that are currently selling, based on the proportion of tariff adjustments on imported vehicles. In this process, some media have misguided and interpreted the “price cuts.†Even worse, they believe that the range of decline can reach 11%-19%. However, the actual situation is that after the tariff adjustment, the cost of imported vehicles is reduced by about 8%. Moreover, the reduction of 8% is just the cost of customs clearance, not the manufacturer's suggested retail price. So how should we count? Let's look down together. How much can the imported car prices fall? Can 8% be used as a benchmark? First, let's find out how the comprehensive tax rate for imported cars is calculated: Comprehensive tax rate = {tariff + value-added tax + consumption tax + (tariff rate × value-added tax rate)} ÷ (1-consumption tax rate) Tariff = declaration price × tariff rate Consumption tax = (customs price + tariff) ÷ (1-consumption tax rate) × excise tax rate VAT = (customs price + tariff + consumption tax) × VAT rate Note: 1 The larger the car's displacement, the higher the consumption tax rate, and the electric car will not calculate the consumption tax; 2 VAT will decrease from 17% to 16% from May 1 this year. We use an import car with a customs declaration price of 300,000 yuan and a displacement of 5.0 liters as an example. Before the tariff reduction, the vehicle will have to pay 25% customs duty, 16% value-added tax and 40% consumption tax, and the combined import tax rate is 141.67%. Finally, the company has to pay a tax of 423.01 million yuan, which means that the imported car The duty-paid price is 7.2501 million yuan. After the tariff was lowered to 15%, the VAT and excise tax rates remained unchanged, and the comprehensive tax rate was reduced to 122.33%. This vehicle eventually had to pay 366.99 million yuan in taxes, and the duty-paid price was 666.99 million yuan, which was 5.8% lower than before the tariff reduction. Ten thousand yuan, 58,000 yuan, 7.25%, 8%. As a result, some media used 8% as a benchmark to judge whether the prices adjusted by automakers were real. If the price reduction was less than 8%, the car company would keep its eyes. If it was higher than 8%, the brand would be very really. Is this statement true? If the duty-paying price of the vehicle = the manufacturer's suggested retail price, the so-called "8% theory" is true. In fact, the manufacturer's suggested retail price for an imported car is made up of five parts: vehicle declaration price, customs duty, consumption tax, VAT, and other expenses. Or it can be simply understood as: Manufacturer's suggested retail price = duty-paid price + other expenses, other expenses include vehicle transportation costs, inspection and inspection costs, port-to-port storage fees, license fees, distributor profits, dealer profits, and so on. Therefore, after an imported vehicle with a duty-paid price of 7,250,100 yuan, plus other fees such as storage fees, transportation fees, and dealer profits, the final manufacturer's suggested retail price may reach around 900,000 yuan. At this time, 58,000 yuan, 900,000 yuan = 6.44%. Obviously, the "8% theory" is not valid. Since the declaration price of each imported vehicle is non-public, the "other expenses" of each vehicle are also different. Therefore, using the manufacturer's suggested retail price of the vehicle and pushing back the formula based on the comprehensive tax rate, it is not the actual declaration price of the vehicle. In other words, the "8%" figure does not set a benchmark for car prices. Mr. He Lun, a joint content officer at China Netcom and a dean of the Automotive Research Institute, said: “The price cuts of car companies cannot be ruled by the reduction of tariffs. The duty-paid price of vehicles does not equal the manufacturer’s suggested retail price. Normally, The price cuts of car manufacturers should be less than 8%, but manufacturers are also likely to adjust their market competition status by reducing the tariff, and reduce the price between the manufacturer's suggested retail price and the vehicle terminal price (the price after dealer discount). difference." Let's look at two "chestnuts" Tesla announced on May 23 that it will adjust the price of the Model S and Model X models that are currently sold in imported form in China. The maximum price reduction will be as high as 9.0021 million yuan, and all undelivered vehicles will follow the new model. The delivery of the tariff under the tariff will be irrespective of when the vehicle is cleared. The details of the price reduction are as follows: After calculation, it can be concluded that the price reductions of the above six models are 6.37%, 6.34%, 6.41%, 6.34%, 6.39%, and 6.4% respectively. Next, let's look at another example. Also on May 23rd, the Jeep official announced that the new Jeep Grand Cherokee imported SUVs will be priced from now on. The official price will be as high as RMB 65,000. Details are as follows: After calculation, the price reductions of the above six models were 8.62%, 8.19%, 8.46%, 8.45%, 8.33%, and 8.45%, respectively. This is a very clear example of two, Tesla's decline in early 6%, while the Jeep Grand Cherokee's decline exceeds 8%. If 8% is the benchmark, then it is concluded that Tesla is not "sincere" and the Jeep Grand Cherokee is very "real", but it is obviously wrong. Tesla's situation is exactly in line with what Mr. He Lun described as a "normal situation." The drop exceeds more than 8%, which should be considered by the manufacturer. Some readers will ask this time, it is normal that the drop is less than 8%. If it is higher than 8%, is it not more beneficial to consumers? Mr. He Lun mentioned in the above is a key point: the price of the vehicle terminal, which is the price after the dealer discount. As we all know, imported cars basically have terminal concessions, and the more expensive car concessions, the greater. After the official price reduction, the vehicle's preferential price before the terminal can maintain tariff adjustment is also an important factor. For example, before a car is lowered, the terminal price of the 4S shop can be reduced by 100,000 yuan. After the official has dropped 100,000 yuan, the terminal discount has been reduced to 50,000 yuan. Then the actual cost of purchasing a naked car by a consumer is only lower than that. Before the reduction of 50,000 yuan. However, the official drop of 100,000 yuan is obviously more attractive than the official drop of 50,000 yuan. There is also a situation that is similar to Toyota Elfa this need to increase the price of the car to import the car, although the official also announced a downward adjustment of the manufacturer's guide price, but the terminal's price increase efforts have changed, the same need to personally go to the 4S shop asked . Of course, regardless of how it is calculated, the drop in tariffs brought about by tariff cuts will certainly benefit consumers. Only when we measure the sincerity of the manufacturers' price cuts, we must not be partial and partial.

Tower Crane cabin is the control center of the crane and is attached to the slewing unit. In order to get to the tower crane cab, the operator must climb a series of ladders within the mast.

The movement of the tower crane is controlled from the operator`s cabin. Within the tower crane cabin, you`ll find the operator`s chair with joystick controller, electronic monitoring devices, and communication systems. Many cabins come with climate control to ensure a comfortable work environment. The Operator Cabin for Tower Crane is part of the slewing assembly. Tower Crane Cab,Tower Crane Cabin Chair,Tower Crane Operator Cabin, Operator Cabin for Tower Crane,Driver's Cabin for Tower Crane SHEN YANG BAOQUAN BUSINESS CO., LTD , https://www.sytopkittowercrane.com